Full protection vehicle insurance describes a combination of insurance protections that safeguard a chauffeur economically for damages to their vehicle, the residents of their automobile, and other vehicles and passengers in an accident. No insurance plan can cover you and your car in every possible scenario, but full protection secures you in the majority of them.

Crash and extensive will protect you and your automobile if you enter into a mishap. If you're discovered at fault for a mishap. liability will spend for damages you might cause to others. Nationwide states it is necessary to recognize that full coverage assists provide the best possible security, but you still have to pay your deductible if you trigger a mishap.

This covers damages that are the result of many kinds of events that happen when your automobile is in motion. It covers your car if you hit a guardrail, a fence, or a light post.

Our Why You Might Not Need Full Coverage Car Insurance Statements

A tree falls on your automobile throughout a windstorm, or when a burglar breaks a window. What Are the Offered Protections? The objective of automobile insurance is to secure you economically if you are associated with an accident. According to The Balance, there are many alternatives for coverage, limits, and deductibles.

Uninsured motorist coverage and underinsured driver coverage with limits that match the liability coverage in your policy for bodily injury. Some states provide uninsured motorist protection for property damage. All readily available coverages for medical costs in the highest quantities possible.

Damage due to a natural catastrophe or theft. 4. If you are at fault, payment for medical treatment for you and your passengers. 5. Injuries to you and your passengers if an uninsured driver strikes you. What Doesn't Full Coverage Insurance Pay For? Most of the times, full protection insurance will not cover:1.

The Only Guide to What Is Full Coverage Car Insurance? - Geico

Damage due to off-road driving3. Usage of the vehicle in a car-sharing program4. Catastrophes, such as war5. Damage to the vehicle or confiscation by government or civil authorities6. Organization usage of the vehicle for delivery purposes7. Intentional damage What Are the State Minimum Requirements for Full Protection? Every state can set its own minimum requirements for car insurance coverage.

Additional protections for your vehicle are not needed. Comprehensive Coverage Comprehensive insurance coverage helps to spend for physical damage to the car or to change it when the damage is not the result of a collision. It could be damage due to theft, wind, hail, or falling objects such as a branch or a tree.

Crash Protection Accident coverage is likewise part of complete protection. This covers your vehicle when it is harmed in a collision with a things or another car. It will likewise cover your lorry if it is included in a single rollover accident. Crash and extensive coverage typically come as a bundle, so you don't get one without the other.

Some Known Details About Differences Between Full Coverage, Liability Car Insurance

Rental Repayment Coverage, Rental compensation protection is often part of complete coverage. This covers a rental automobile while yours is in the look for repair work after a mishap or a covered loss. The insurance coverage will generally conceal to a set dollar amount each day for a predetermined variety of days.

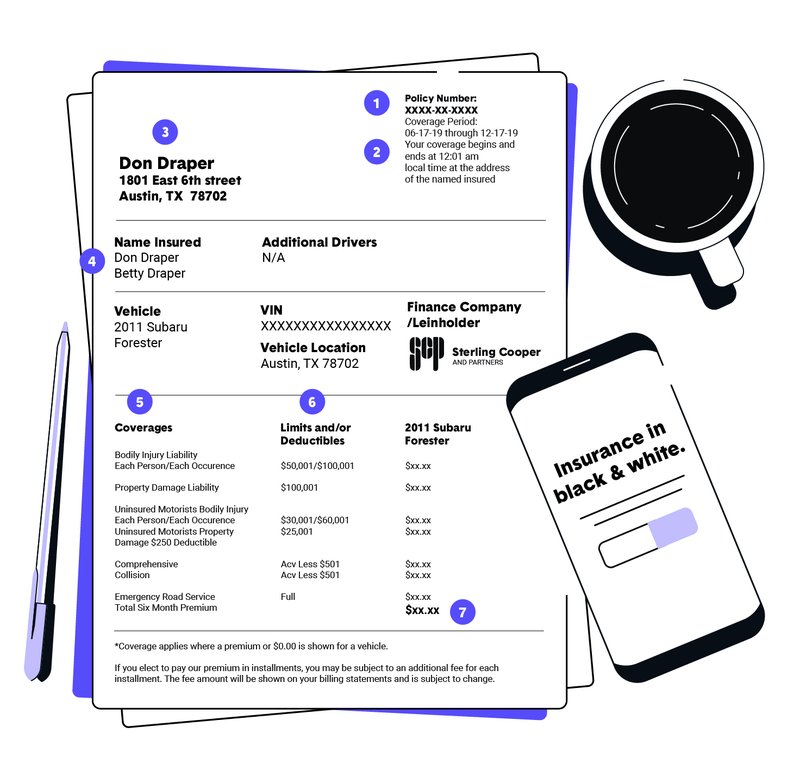

What Is a Limitation? The coverage limit is the maximum dollar amount that a vehicle insurer will pay for a covered claim. When the limitation is reached, the insured is responsible for paying for the rest. It is necessary to remember that complete protection is not a kind of policy, however a mix of insurance coverage coverages.

This content is created and maintained by a 3rd celebration, and imported onto this page to assist users supply their email addresses. You may be able to find more details about this and similar content at.

The smart Trick of Car Insurance - Farm Bureau Financial Services That Nobody is Discussing

Key takeaways, Complete coverage vehicle insurance isn't a particular type of policy, but rather a combination of coverage types. You might desire or require complete coverage insurance coverage if you have a new car, reside in a place with severe weather conditions or have an auto loan or lease. Policies with full protection can cost twice as much as state-mandated insurance, however uses higher defense.

Even though you've most likely become aware of complete coverage insurance coverage, there's no such thing as a "full coverage policy."Complete coverage vehicle insurance definition, Complete coverage insurance generally combines collision and extensive insurance coverage, which pay out if your lorry is damaged, plus liability coverage, which pays for injuries and damage you cause to others.

You live in a location with severe weather condition, high vehicle theft rates or a high danger of animal crashes. For an older vehicle, nevertheless, full protection may not be worth the expense.

Facts About What Does Comprehensive Auto Insurance Cover? - Money ... Revealed

And they usually have an insurance coverage deductible, a quantity you're anticipated to pay of pocket towards repair or replacement. Picture it costs you $600 annually for comprehensive and collision, and you have a $1,000 deductible. If your cars and truck is worth $1,500, a claim check would be $1,000 at many.

Examining your car's current value can assist you choose whether full protection makes good sense. Even with full coverage, there are other policy alternatives you may need. Uninsured driver protection, space insurance coverage and medical payments insurance coverage all pay for expenses full coverage cars and truck insurance won't. If you're on the fence, play with the protection options you see online when going shopping for vehicle insurance coverage quotes.

Speeding tickets, mishaps and DUIs can increase your car insurance coverage rates dramatically, even after one occurrence. Your credit history can have a big effect on your automobile insurance expense.

6 Easy Facts About Automobile Insurance Guide - Pennsylvania Insurance ... Described

Frequently asked questions, What isn't consisted of in full coverage? Despite the name, complete coverage insurance does not consist of everything. Depending upon your state minimums, coverage that might not be thought about full coverage include: Is complete coverage automobile insurance coverage worth it? Policies with full protection pay out if your automobile is damaged, while minimum insurance coverage usually just covers damage to another car or individual.

What is "complete protection" automobile insurance? There's no standard definition of "full protection" cars and truck insurance coverage. Cars and truck insurance isn't a one-size-fits-all purchase. Your car insurance need to be personalized to fit your need. A couple of things you ought to consider are how much coverage you 'd need to secure your home and properties. Based upon your circumstance, your version of full coverage may differ from somebody else's.

What protections make up an automobile insurance coverage? Auto insurance coverage have state-required protections that include limits you're legally needed to have. Then there are optional protections and protection limitations. The protections and limitations of coverage differ by state. Wish to know more about your state? Have a look at the state information pages.